Keeping you informed about recent events and developments within the VRS and how we are helping vulnerable people to make organisations aware of their circumstances.

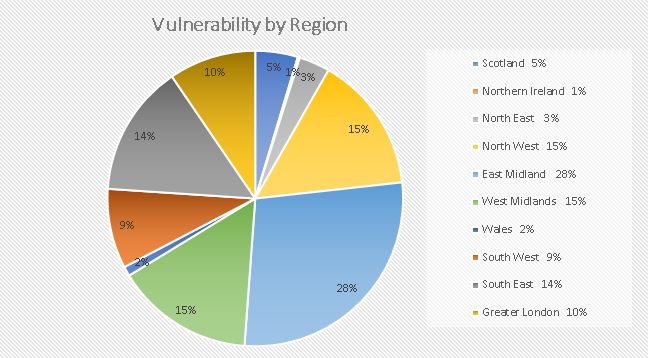

As the Vulnerability database builds in volume, we thought it would be useful to check out where the most registrations were coming from in the UK. Hopefully, this will help organisations assess how registrations are relevant to their own customer-base, particularly if an organisation has a high proportion of customers in a specific region.

It remains free to load information to the Vulnerability Registration Service and if any company would like to conduct a pilot of using the service, please contact us.

Scotland 5% Northern Ireland 1% North East 3% North West 15% East Midland 28% West Midlands 15% Wales 2% South West 9% South East 14% Greater London 10%

Our Advisory Board

We are now extremely proud to have established our Advisory Board with a number of experts to help provide thought leadership while we continue to develop the Vulnerability Registration Service. Their wealth of experience combines an understanding of the commercial demands upon organisations while comprehending the importance of supporting individuals.

We are confident that the Board, in view of their broad experience, will help us to continue to develop a service that will help vulnerable individuals and the organisations who recognise the need to treat customers fairly. By sharing data between organisations and cross-sector, we believe the Vulnerability Registration Service will build to give an holistic view of vulnerability and streamline our ability to treat people in the right way and in a way that will minimise cost for companies.

James Jones

James is Experian’s Head of Consumer Affairs and leads the company’s public education programme guiding people on subjects such as credit reporting, credit scoring and identity fraud.

James regularly features on television and radio and in print and online media. He also runs an expert advice column on the Experian website and represents Experian at cross-industry forums. He is a director of the Money Advice Liaison Group (MALG).

James’ focus is upon supporting the consumer and enabling them to understand how their financial affairs will impact their lives.

Nick Pearson

Nick is regarded as one of the UK’s leading experts on personal debt having worked as a debt recovery consultant to several national financial institutions and served as a member of a wide variety of government task forces and advisory groups.

Nick is Head of External Relations at Gregory Pennington Limited, part of the Think Money Group. Previously, he was CEO of the Debt Counsellors Charitable Trust, having been appointed to set up the charity in 2014, and Director of External Affairs at the Paymex Group.

Nick was the National Debt Advice Coordinator at AdviceUK and Head of Debt Advice at the Citizens Advice office in London. He has worked as a specialist money/debt advisor and debt advice centre manager in organisations including a number of citizens advice bureaus, an independent advice centre, a students’ union and a local authority.

In addition, Nick has been a director and board member of the United Utilities Trust Fund, the Debt Managers Standards Association, Debt Resolution Forum and the Institute of Money Advisors. He has also been a member of the Financial Services Panel.

Anthony Sharp

The course of Anthony’s diverse career means that he can provide us with an invaluable amount of insight while we build our service. His experience means that he is sought after as lecturer and conference chair and to provide training.

Anthony has worked with Barclays International, the Church of England Children’s Society and the NSPCC as national fundraising organiser. He has held senior positions in the credit industry with Bentalls Plc and Asprey Plc and then joined the Consumer Credit Trade Association (CCTA) creating a long-running training operation. Much of this experience contributed to Anthony receiving the prestigious ‘Contribution to the Credit Industry’ award at the Credit Today Award Ceremony in May 2006.

Anthony was Chairman of the Central Region of the Civil Court Users Association (CCUA) for 19 years and now holds the position of Company Secretary for the CCUA. He was co-founder of the Money Advice Liaison Group and held the position of Chair for 29 years. He has held many distinguished positions in areas that are totally relevant to helping deal with vulnerability and made many contributions about how the issue should be addressed.

He was appointed as a member of the Bristol University Personal Finance Research on vulnerability and he is a member of the Money and Mental Health Policy Institute Advisory Board

Sue Wishart

Sue has extensive experience working in credit bureaus. She has strong commercial experience having had responsibility for the marketing of new services and databases to a variety of sectors. Sue also worked with many companies to enable them to use the Gone Away Information Network.

Sue worked as Head of Business Engagement for CIFAS, the UK’s largest cross-sector fraud sharing organisation, working with organisations to enable them to effectively utilise the CIFAS database to meet their business needs.

Sue’s experience has meant that she has a strong understanding about how data can be responsibly shared to effectively achieve the stated aims of any particular scheme and understand how to work with new sectors with various data sharing initiatives.

Post a comment