Getting our heads around the numbers we’re sent by firms is often tricky. This can leave people confused, anxious and struggling. Changing the way numbers are communicated can change the customer experience for the better and Plain Numbers is working with firms to do exactly that.

Poor Numeracy as a Consumer Vulnerability

Almost half the UK working age population have the numeracy levels at or below the expectations of a primary school child. It’s not just skills that hold people back when working with numbers, confidence is critical too. At least 1 in 5 people experience Maths Anxiety – a negative emotive response when faced with numbers. This can lead to people avoiding financial communications altogether.

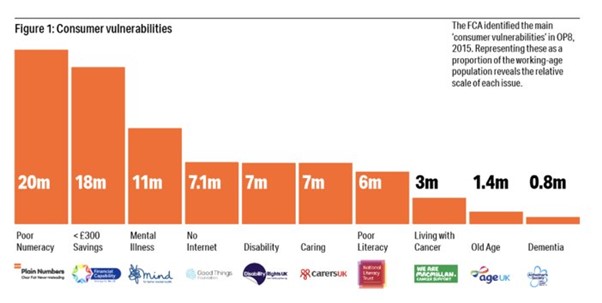

The FCA first recognised poor numeracy as a customer vulnerability in Occasional Paper 8 published in 2015. It has since referenced numeracy levels as a vulnerability firms must be aware of when they communicate in a New Consumer Duty.

Of the factors identified by the FCA in 2015, it was the one that impacts the largest number of adults.

This does not mean to say that one person impacted by poor numeracy is impacted to the same degree as one person who experiences other vulnerabilities. But it does highlight that it is a factor that should not be ignored.

Doubling Consumer Comprehension

Research by Plain Numbers paints an alarming picture of the current understanding customers have of the information they receive.

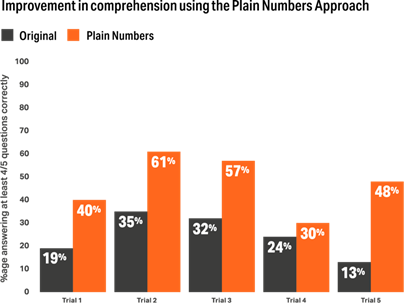

Through randomised control trials the research asked five hundred people questions to demonstrate their understanding of communications. The questions were based on the basic information that the firms expected customers to be able to gain from it. The results showed that in all the trials, across five communications in four different industries, around a third or less of people could answer four or five out of five questions correctly.

However, when five hundred people were shown the Plain Numbers version, the proportion who could answer four or five questions correctly dramatically increased. In fact, on average it doubled the number of people who demonstrated they could understand the information.

The trials used different forms of communication, including digital and paper-based, from five market leading firms. Given the forward-thinking nature of the firms who chose to take part and the strong reputation some have for their communication, it is reasonable to expect these results could be higher than the industry standard.

Perception vs Reality

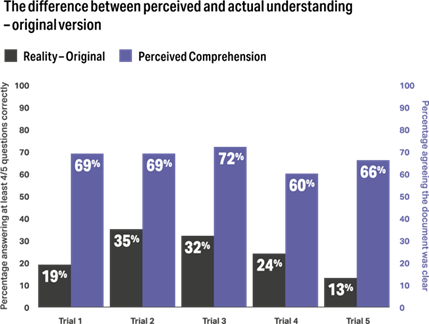

An equally important finding in terms of vulnerability was that often customers thought they understood the communication, but the reality was that they couldn’t demonstrate this.

Before being asked the five comprehension questions, people were asked whether they thought the communication was “clear, fair and easy to understand.” In all cases around seven out ten people agreed or strongly agreed.

This means that there was a significant proportion of customers who believed they understood, but actually didn’t. It is therefore impossible for these customers to make informed choices. The Plain Numbers version went a significant way towards closing the gap between perception and reality.

Informed choice and good customer outcomes

In most of the financial decisions we all make, the key messages in a communication are about the numbers. For example, without understanding the figures how can someone:

- Save money on everyday bills by finding the best deals;

- Know if they can afford repayments on a new credit arrangement;

- Work out if they are saving enough for retirement; or

- Keep control of any debt they might have.

In all of these situations, a customer with a poor understanding of the numbers can’t make an informed decision. This really restricts the customer from achieving the right outcomes for them.

Many organisations have worked hard for years on simplifying language, which is important work. However, once you know how many people struggle with numeracy, it feels impossible that consumer comprehension will improve without addressing the numbers too.

We believe that firms must address this as part of their vulnerable customer strategy by taking a Plain Numbers Approach to their communications. It’s essential to ensure that customers have the understanding they need to make informed decisions with their money and numbers are critical to this. Against the backdrop of the cost of living crisis and A New Consumer Duty, this becomes more important than ever.

Ben Perkins, Plain Numbers

Post a comment